2023-10-notional-judging's People

2023-10-notional-judging's Issues

shealtielanz - ` params.oracleSlippagePercentOrLimit` for static trades is not checked.

shealtielanz

medium

params.oracleSlippagePercentOrLimit for static trades is not checked.

Summary

Static Trades might be settled with a large slippage causing a loss of assets as the oracleSlippagePercentOrLimit limit is not bounded, and can exceed the Constants.SLIPPAGE_LIMIT_PRECISION threshold.

Vulnerability Detail

static trades allow any params.oracleSlippagePercentOrLimit without check mating it, on the call to _executeTradeWithStaticSlippage()

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L152C1-L176C6

function _executeTradeWithStaticSlippage(

ITradingModule tradingModule,

TradeParams memory params,

address sellToken,

address buyToken,

uint256 amount

) internal returns (uint256 amountSold, uint256 amountBought) {

require(

params.tradeType == TradeType.EXACT_IN_SINGLE ||

params.tradeType == TradeType.EXACT_IN_BATCH

);

Trade memory trade = Trade(

params.tradeType,

sellToken,

buyToken,

amount,

params.oracleSlippagePercentOrLimit,

block.timestamp, // deadline

params.exchangeData

);

// Execute trade using the absolute slippage limit set by `oracleSlippagePercentOrLimit`

(amountSold, amountBought) = trade._executeTrade(params.dexId, tradingModule);

}this function is used during reward reinvestment trades.

Impact

Trade can settle with a high slippage.

Code Snippet

Tool used

Manual Review

Recommendation

Consider restricting the slippage limit when executing static trades.

Bauer - Risk of reward loss and incomplete exit handling in `emergencyExit()` function

Bauer

high

Risk of reward loss and incomplete exit handling in emergencyExit() function

Summary

The emergencyExit() function currently lacks a mechanism to claim rewards during the exit process, potentially resulting in the loss of rewards.

Vulnerability Detail

The SingleSidedLPVaultBase.emergencyExit() function is designed for emergency situations, allowing the strategy to exit the pool and redeem a specified amount of pool assets.

The protocol currently executes _unstakeAndExitPool() in the emergencyExit() function, but it does not retrieve the rewards obtained during the exit. This design could pose a risk in situations where third-party protocols are compromised or during other emergency scenarios, potentially leading to the loss of rewards.

function emergencyExit(

uint256 claimToExit, bytes calldata /* data */

) external override onlyRole(EMERGENCY_EXIT_ROLE) {

StrategyVaultState memory state = VaultStorage.getStrategyVaultState();

if (claimToExit == 0) claimToExit = state.totalPoolClaim;

// By setting min amounts to zero, we will accept whatever tokens come from the pool

// in a proportional exit. Front running will not have an effect since no trading will

// occur during a proportional exit.

_unstakeAndExitPool(claimToExit, new uint256[](NUM_TOKENS()), true);

state.totalPoolClaim = state.totalPoolClaim - claimToExit;

state.setStrategyVaultState();

emit EmergencyExit(claimToExit);

_lockVault();

}

Impact

Rewards may be at risk of loss.

Code Snippet

Tool used

Manual Review

Recommendation

Perform the operation of claimRewardTokens() and reinvestReward() internally within the emergencyExit() function

AuditorPraise - `borrowedCurrencyAmount` gotten from calling `_redeemFromNotional()` in `BaseStrategyVault.redeemFromNotional()` will be inflated because primary token gotten from executing trades on external exchanges is not transferred back to the vaults from the Trading Module

AuditorPraise

high

borrowedCurrencyAmount gotten from calling _redeemFromNotional() in BaseStrategyVault.redeemFromNotional() will be inflated because primary token gotten from executing trades on external exchanges is not transferred back to the vaults from the Trading Module

Summary

primary tokens gotten from executing trades on external exchanges is not transferred back to the vaults from the Trading Module, this will cause issues in the BaseStrategyVault.redeemFromNotional() function

Vulnerability Detail

The vaults will use TradingModule.sol to execute trades on Dexes.

They will sell a certain amount of sellToken for buyToken(primary token).

The issue is that after the vaults use the TradingModule contract to execute trades on Dexes, the primary tokens(buy Token) gotten from executing trades on external exchanges is not transferred back to the vaults from the Trading Module

Now amount of primary token gotten from executing trades on external exchanges will reflect in borrowedCurrencyAmount but it's not really transferred back into the vaults, so borrowedCurrencyAmount will always be inflated above the balance of _UNDERLYING_TOKEN that is really in the vault resulting in issues here

The main logic of this vulnerability here is that borrowedCurrencyAmount will be inflated by the amount of primary token gotten from executing trades on external exchanges but the primary tokens aren't sent back into the vaults.

SO the primary tokens gotten from the executing trades on external exchanges won't reflect in the balance of the _UNDERLYING_TOKEN.

Impact

borrowedCurrencyAmount gotten from calling _redeemFromNotional() in BaseStrategyVault.redeemFromNotional() will be inflated because primary token gotten from executing trades on external exchanges is not transferred back to the vaults from the Trading Module

BaseStrategyVault.redeemFromNotional() may always revert because borrowedCurrencyAmount will always be inflated above the balance of _UNDERLYING_TOKEN that is really in the vault here

transferToNotional may always be greater than balance of _UNDERLYING_TOKEN causing reverts due to insufficient balance

Code Snippet

Tool used

Manual Review

Recommendation

transfer the primary token gotten from executing trades on external exchanges back into the vaults

shealtielanz - Incorrect computing of the Invariant due to rounding differences

shealtielanz

high

Incorrect computing of the Invariant due to rounding differences

Summary

The invariant used within BalancerSpotPrice.sol to compute the spot price is not aligned with the Balancer's ComposableStablePool due to rounding differences. The spot price is used to verify if the pool has been manipulated before executing certain key vault actions (e.g. settle vault, reinvest rewards). In the worst-case scenario, it might potentially fail to detect the pool has been manipulated as the spot price computed might be inaccurate.

Vulnerability Detail

The BalancerSpotPrice.sol relies on the old version of the StableMath._calculateInvariant that allows the caller to specify if the computation should round up or down via the roundUp parameter.

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/balancer/math/StableMath.sol#L28C1-L85C6

function _calculateInvariant(

uint256 amplificationParameter,

uint256[] memory balances,

bool roundUp

) internal pure returns (uint256) {

/**********************************************************************************************

// invariant //

// D = invariant D^(n+1) //

// A = amplification coefficient A n^n S + D = A D n^n + ----------- //

// S = sum of balances n^n P //

// P = product of balances //

// n = number of tokens //

*********x************************************************************************************/

unchecked {

// We support rounding up or down.

uint256 sum = 0;

uint256 numTokens = balances.length;

for (uint256 i = 0; i < numTokens; i++) {

sum = sum.add(balances[i]);

}

if (sum == 0) {

return 0;

}

uint256 prevInvariant = 0;

uint256 invariant = sum;

uint256 ampTimesTotal = amplificationParameter * numTokens;

for (uint256 i = 0; i < 255; i++) {

uint256 P_D = balances[0] * numTokens;

for (uint256 j = 1; j < numTokens; j++) {

P_D = Math.div(Math.mul(Math.mul(P_D, balances[j]), numTokens), invariant, roundUp);

}

prevInvariant = invariant;

invariant = Math.div(

Math.mul(Math.mul(numTokens, invariant), invariant).add(

Math.div(Math.mul(Math.mul(ampTimesTotal, sum), P_D), _AMP_PRECISION, roundUp)

),

Math.mul(numTokens + 1, invariant).add(

// No need to use checked arithmetic for the amp precision, the amp is guaranteed to be at least 1

Math.div(Math.mul(ampTimesTotal - _AMP_PRECISION, P_D), _AMP_PRECISION, !roundUp)

),

roundUp

);

if (invariant > prevInvariant) {

if (invariant - prevInvariant <= 1) {

return invariant;

}

} else if (prevInvariant - invariant <= 1) {

return invariant;

}

}

}

revert CalculationDidNotConverge();

}Within the BalancerSpotPrice._calculateStableMathSpotPrice() function, the StableMath._calculateInvariant() is computed rounding up.

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/balancer/BalancerSpotPrice.sol#L78C1-L97C6

function _calculateStableMathSpotPrice(

uint256 ampParam,

uint256[] memory scalingFactors,

uint256[] memory balances,

uint256 scaledPrimary,

uint256 primaryIndex,

uint256 index2

) internal pure returns (uint256 spotPrice) {

// Apply scale factors

uint256 secondary = balances[index2] * scalingFactors[index2] / BALANCER_PRECISION;

uint256 invariant = StableMath._calculateInvariant(

ampParam, StableMath._balances(scaledPrimary, secondary), true // round up

);

..SNIP..

}The issue is that Balancer ComposableStablePool uses a newer version of the StableMath library where the StableMath._calculateInvariant function always rounds down.

https://etherscan.io/address/0xa13a9247ea42d743238089903570127dda72fe44#code#F16#L57

function _calculateInvariant(uint256 amplificationParameter, uint256[] memory balances)

internal

pure

returns (uint256)

{

/**********************************************************************************************

// invariant //

// D = invariant D^(n+1) //

// A = amplification coefficient A n^n S + D = A D n^n + ----------- //

// S = sum of balances n^n P //

// P = product of balances //

// n = number of tokens //

**********************************************************************************************/

// Always round down, to match Vyper's arithmetic (which always truncates).

uint256 sum = 0; // S in the Curve version

uint256 numTokens = balances.length;

for (uint256 i = 0; i < numTokens; i++) {

sum = sum.add(balances[i]);

}

if (sum == 0) {

return 0;

}

..SNIP..Thus, Notional round up when calculating the invariant while Balancer's ComposableStablePool round down when calculating the invariant. This inconsistency will result in a different invariant

- You can futher down the line see that

BalancerSpotPrice._calculateStableMathSpotPrice()is called by BalancerSpotPrice.getComposableSpotPrices() to calculate spot prices which is called byBalancerComposableAuraVaul._checkPriceAndCalculateValue()to get balances and spot price that would be later used to calculate the LP tokens. BalancerComposableAuraVaul._checkPriceAndCalculateValue()is used to calculate the exchange rate, oracle prices and strategy for an underlying token in SingleSidedLPVaultBase.sol.- reinvestReward() uses

BalancerComposableAuraVaul._checkPriceAndCalculateValue()to check if the spot prices are in line with the oracle values.

Impact

The invariant is used to compute the spot price to verify if the pool has been manipulated before executing certain key vault actions (e.g. settle vault, reinvest rewards). If the inputted invariant is inaccurate, the spot price computed might not be accurate and might not match the actual spot price of the Balancer Pool. In the worst-case scenario, it might potentially fail to detect the pool has been manipulated and the trade proceeds to execute against the manipulated pool leading to a loss of assets.

Code Snippet

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/balancer/BalancerSpotPrice.sol#L78C1-L97C6

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/balancer/math/StableMath.sol#L28C1-L85C6

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/balancer/BalancerSpotPrice.sol#L49C1-L75C10

Tool used

Manual Review, Past contest report for Notional -> sherlock-audit/2022-12-notional-judging#17

Recommendation

To avoid any discrepancy in the result, ensure that the StableMath library used by Balancer's ComposableStablePool and Notional's BalancerSpotPrice. and the implementation of the StableMath functions is the same between them.

Duplicate of #77

ginlee - No validation for primaryIndex may lead to unexpected amountOut for user

ginlee

medium

No validation for primaryIndex may lead to unexpected amountOut for user

Summary

Vulnerability Detail

Since executeRedemptionTrades is a public function, anyone can call with random primaryIndex

address primaryToken = address(tokens[primaryIndex])if primaryIndex is larger than tokens.length, instead of reverting, primaryToken will be set to 0 address, it will be passed as fourth param in _executeDynamicSlippageTradeExactIn

if (exitBalances[i] > 0) {

(/* */, uint256 amountBought) = _executeDynamicSlippageTradeExactIn(

Deployments.TRADING_MODULE, t, address(tokens[i]), primaryToken, exitBalances[i]

);In _executeDynamicSlippageTradeExactIn, fourth param is buyToken and is used to calculate trade, which may lead to unexpected amountOut for user

function _executeDynamicSlippageTradeExactIn(

ITradingModule tradingModule,

TradeParams memory params,

address sellToken,

address buyToken,

uint256 amount

) internal returns (uint256 amountSold, uint256 amountBought)Impact

If the transaction is executed in some way with the buyToken as a zero address, funds may be directed to an unpredictable destination, or the transaction logic may operate in an unintended manner.

Code Snippet

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L59-L87

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L119-L147

Tool used

Manual Review

Recommendation

It is necessary to ensure that primaryIndex does not exceed the bounds of the tokens array

require(primaryIndex < tokens.length, "primaryIndex out of bounds");ke1caM - Initialization can be front-run in `CrossCurrencyVault`.

ke1caM

medium

Initialization can be front-run in CrossCurrencyVault.

Summary

initialize function in CrossCurrencyVault can be front-run.

Vulnerability Detail

function initialize(

string memory name_,

uint16 borrowCurrencyId_,

uint16 lendCurrencyId_

) external initializer {

__INIT_VAULT(name_, borrowCurrencyId_);

LEND_CURRENCY_ID = lendCurrencyId_;

(/* */, Token memory underlyingToken) = NOTIONAL.getCurrency(lendCurrencyId_);

LEND_ETH = underlyingToken.tokenType == TokenType.Ether;

IERC20 tokenAddress = IERC20(underlyingToken.tokenAddress);

LEND_UNDERLYING_TOKEN = tokenAddress;

LEND_DECIMALS = TokenUtils.getDecimals(address(tokenAddress));

BORROW_DECIMALS = TokenUtils.getDecimals(address(_underlyingToken()));

}initialize function lacks access control which means that anyone can call it. This function is used to set the important state variables that enable correct functionality of the protocol. User could front-run admin's / owner's transaction and initialize it with different parameters.

Impact

Protocol functionality could be disrupted due to missing access control. User can front-run initialization of the smart contract.

Code Snippet

Tool used

Manual Review

Recommendation

Add onlyNotionalOwner modifer to initialize function to restrict addresses other than owner from calling this function.

bin2chen - reinvestReward() generates dust totalPoolClaim causing vault abnormal

bin2chen

medium

reinvestReward() generates dust totalPoolClaim causing vault abnormal

Summary

If the first user deposits too small , due to the round down, it may result in 0 shares, which will result in 0 shares no matter how much is deposited later.

In National, this situation will be prevented by setting a minimum borrow size and a minimum leverage ratio.

However, reinvestReward() does not have this restriction, which may cause this problem to still exist, causing the vault to enter an abnormal state.

Vulnerability Detail

The calculation of the shares of the vault is as follows:

function _mintVaultShares(uint256 lpTokens) internal returns (uint256 vaultShares) {

StrategyVaultState memory state = VaultStorage.getStrategyVaultState();

if (state.totalPoolClaim == 0) {

// Vault Shares are in 8 decimal precision

@> vaultShares = (lpTokens * uint256(Constants.INTERNAL_TOKEN_PRECISION)) / POOL_PRECISION();

} else {

vaultShares = (lpTokens * state.totalVaultSharesGlobal) / state.totalPoolClaim;

}

// Updates internal storage here

state.totalPoolClaim += lpTokens;

state.totalVaultSharesGlobal += vaultShares.toUint80();

state.setStrategyVaultState();If the first deposit is too small, due to the conversion to INTERNAL_TOKEN_PRECISION, the precision is lost, resulting in vaultShares=0. Subsequent depositors will enter the second calculation, but totalVaultSharesGlobal=0, so vaultShares will always be 0.

To avoid this situation, Notional has restrictions.

hey guys, just to clarify some rounding issues stuff on vault shares and the precision loss. Notional will enforce a minimum borrow size and a minimum leverage ratio on users which will essentially force their initial deposits to be in excess of any dust amount. so we should not really see any tiny deposits that result in rounding down to zero vault shares. If there was rounding down to zero, the account will likely fail their collateral check as the vault shares act as collateral and the would have none.

there is the possibility of a dust amount entering into depositFromNotional in a valid state, that would be due to an account "rolling" a position from one debt maturity to another. in this case, a small excess amount of deposit may come into the vault but the account would still be forced to be holding a sizeable position overall due to the minium borrow size.

in reinvestReward(), not this limit

function reinvestReward(

SingleSidedRewardTradeParams[] calldata trades,

uint256 minPoolClaim

) external whenNotLocked onlyRole(REWARD_REINVESTMENT_ROLE) returns (

address rewardToken,

uint256 amountSold,

uint256 poolClaimAmount

) {

// Will revert if spot prices are not in line with the oracle values

_checkPriceAndCalculateValue();

// Require one trade per token, if we do not want to buy any tokens at a

// given index then the amount should be set to zero. This applies to pool

// tokens like in the ComposableStablePool.

require(trades.length == NUM_TOKENS());

uint256[] memory amounts;

(rewardToken, amountSold, amounts) = _executeRewardTrades(trades);

poolClaimAmount = _joinPoolAndStake(amounts, minPoolClaim);

// Increase LP token amount without minting additional vault shares

StrategyVaultState memory state = VaultStorage.getStrategyVaultState();

@> state.totalPoolClaim += poolClaimAmount;

state.setStrategyVaultState();

emit RewardReinvested(rewardToken, amountSold, poolClaimAmount);

}From the above code, we know that reinvestReward() will increase totalPoolClaim, but will not increase totalVaultSharesGlobal.

This will cause problems in the following scenarios:

- The current vault has deposits.

Rewardshave been generated, butreinvestReward()has not been executed.- The

botsubmitted thereinvestReward()transaction. but step 4 execute first - The users took away all the deposits

totalPoolClaim = 0,totalVaultSharesGlobal=0. - At this time

reinvestReward()is executed, thentotalPoolClaim > 0,totalVaultSharesGlobal=0. - Other users' deposits will fail later

It is recommended that reinvestReward() add a judgment of totalVaultSharesGlobal>0.

Note: If there is a malicious REWARD_REINVESTMENT_ROLE, it can provoke this issue by donating reward token and triggering reinvestReward() before the first depositor appears.

Impact

reinvestReward() generates dust totalPoolClaim causing vault abnormal

Code Snippet

Tool used

Manual Review

Recommendation

function reinvestReward(

SingleSidedRewardTradeParams[] calldata trades,

uint256 minPoolClaim

) external whenNotLocked onlyRole(REWARD_REINVESTMENT_ROLE) returns (

address rewardToken,

uint256 amountSold,

uint256 poolClaimAmount

) {

// Will revert if spot prices are not in line with the oracle values

_checkPriceAndCalculateValue();

// Require one trade per token, if we do not want to buy any tokens at a

// given index then the amount should be set to zero. This applies to pool

// tokens like in the ComposableStablePool.

require(trades.length == NUM_TOKENS());

uint256[] memory amounts;

(rewardToken, amountSold, amounts) = _executeRewardTrades(trades);

poolClaimAmount = _joinPoolAndStake(amounts, minPoolClaim);

// Increase LP token amount without minting additional vault shares

StrategyVaultState memory state = VaultStorage.getStrategyVaultState();

+ require(state.totalVaultSharesGlobal > 0 ,"invalid shares");

state.totalPoolClaim += poolClaimAmount;

state.setStrategyVaultState();

emit RewardReinvested(rewardToken, amountSold, poolClaimAmount);

}

0xpep7 - Potential reversion in the Curve2TokenConvexVault.emergencyExit function when the Curve pool is killed, leading to vault locking failure

0xpep7

medium

Potential reversion in the Curve2TokenConvexVault.emergencyExit function when the Curve pool is killed, leading to vault locking failure

Summary

If the underlying Curve pool's self.is_killed becomes true, the emergencyExit() function in Curve2TokenConvexVault may fail to execute, preventing the intended withdrawal and locking of the vault. This vulnerability could result in the loss of funds and compromise the emergency protection mechanism of the vault.

Vulnerability Detail

The Curve2TokenConvexVault.emergencyExit() function is used to trigger an emergency exit on the vault which involves withdrawing the LP tokens in a Curve pool by calling _unstakeAndExitPool with isSingleSided = true. The _unstakeAndExitPool then proceeds to remove the LP tokens from the Curve pool via remove_liquidity_one_coin.

// File: leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol

480: function emergencyExit(

...

489: _unstakeAndExitPool(claimToExit, new uint256[](NUM_TOKENS()), true); // <= FOUND: always reverts if the Curve pool is killed

...

494: emit EmergencyExit(claimToExit);

495: _lockVault(); // <= FOUND: unable to lock the vault if _unstakeAndExitPool reverts

496: }

// File: leveraged-vaults/contracts/vaults/Curve2TokenConvexVault.sol

66: function _unstakeAndExitPool(

...

80: if (isSingleSided) {

81: // Redeem single-sided

82: exitBalances[_PRIMARY_INDEX] = pool.remove_liquidity_one_coin( // <= FOUND

83: poolClaim, int8(_PRIMARY_INDEX), _minAmounts[_PRIMARY_INDEX]

84: );

...

95: }The root cause of the vulnerability is that the emergencyExit() function relies on the remove_liquidity_one_coin function in the underlying Curve pool contract. If the Curve pool is killed (self.is_killed is true), calling remove_liquidity_one_coin always reverts at the assertion below, leading to the failure of the emergency exit process.

670: def remove_liquidity_one_coin(_token_amount: uint256, i: int128, min_amount: uint256):

671: """

672: Remove _amount of liquidity all in a form of coin i

673: """

674: assert not self.is_killed # dev: is killedImpact

There are two impacts that should be discussed in this case:

- Funds remain locked in the Curve pool until the

BaseStrategyVault.redeemFromNotionalfunction is called by Notional to redeem tokens proportionally viaremove_liquidityinstead. However, this still defeats the core functionality of theemergencyExitfunction. - The

_lockVaultcan never be called due to reversion of_unstakeAndExitPoolwhich leads to the associated protection mechanisms, such as locking the vault, cannot be executed. In the event of an emergency, where it is crucial to locking the vault, the inability to call_lockVault()effectively leaves the vault vulnerable to unknown potential exploits. This should be a Med severity based on Sherlock docs's Section V.2

Code Snippet

Tool used

Manual Review

Recommendation

It is recommended to enhance the emergencyExit() function to handle the scenario where the Curve pool is killed. The function should accept an additional parameter, isKilled, and adjust the call to _unstakeAndExitPool accordingly, ensuring that emergency exits can still be performed even if the underlying Curve pool is in a killed state.

Note: Similar report was previously accepted as Med severity.

Duplicate of #96

wangxx2026 - Loss of judgment on withdrawal asset length and slippage length leads to redemption failure

wangxx2026

medium

Loss of judgment on withdrawal asset length and slippage length leads to redemption failure

Summary

Loss of judgment on withdrawal asset length and slippage length leads to redemption failure

Vulnerability Detail

In the redemption of BalancerComposableAuraVault and BalancerWeightedAuraVault, the parameter transfer path for slippage judgment is:

sequenceDiagram

redeemFromNotional->>_redeemFromNotional: data

_redeemFromNotional->>_unstakeAndExitPool: data.decode

_unstakeAndExitPool->>_exitPoolExactBPTIn: minAmounts

_exitPoolExactBPTIn->>BALANCER_VAULT: exitPool.amounts

In this process, it is never judged whether the length of minAmountsde is the same as the length of assets. In the BALANCER_VAULT code and the document, it is clearly required that the length of the slippage array needs to be the same as the length of the redeemed assets.

When depositing assets, there is a clear judgment. This may be due to the negligence of the developer.

Impact

Loss of judgment on withdrawal asset length and slippage length leads to redemption failure

Code Snippet

Tool used

Manual Review

Recommendation

Add

require(assets.length == amounts.length);judgment before requesting, and ensure the order is consistent

ginlee - Can't use block.timestamp as deadline since it can be manipulated

ginlee

medium

Can't use block.timestamp as deadline since it can be manipulated

Summary

Normally in trading, users will specify a deadline parameter that enforces a time limit by which the transaction must be executed. Without a deadline parameter, the transaction may sit in the mempool and be executed at a much later time potentially resulting in a worse price for the user. Protocols shouldn't set the deadline to block.timestamp as a validator can hold the transaction and the block it is eventually put into will be block.timestamp, so this offers no protection.

Vulnerability Detail

Trade memory trade = Trade(

params.tradeType,

sellToken,

buyToken,

amount,

0, // No absolute slippage limit is set here

block.timestamp, // deadline

params.exchangeData

);In Trade, block.timestamp is passed as deadline for this transaction, may result in a worse price for the user

Impact

Code Snippet

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L140

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L170

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/CrossCurrencyVault.sol#L177

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/CrossCurrencyVault.sol#L248

Tool used

Manual Review

Recommendation

Protocols should allow users to set expiration deadlines by themselves

Duplicate of #115

djanerch - Gas limit DoS via unbounded operations

djanerch

medium

Gas limit DoS via unbounded operations

Summary

If a function requires more gas than the block gas limit to complete its execution, it will inevitably fail. These vulnerabilities typically occur in loops that iterate over dynamic data structures.

Vulnerability Detail

Certain functions in contracts take arrays as input and iterate over them without checking their sizes. This oversight can lead to reaching the block gas limit and resulting in a reverted transaction.

Impact

Functions vulnerable to gas limits can become uncallable, potentially locking funds or freezing the contract state.

Code Snippet

Tool Used

Manual Review

Recommendation

To ensure that functions like these are bounded and prevent array exhaustion, include proper input validation mechanisms in your smart contract. Follow these general guidelines:

-

Check Array Length:

- Before iterating over arrays, verify that the length of the array is within reasonable bounds to prevent exhaustion. Utilize the

requirestatement for this purpose.

function executeDepositTrades(uint256[] memory amounts) external { require(amounts.length <= MAX_ARRAY_LENGTH, "Array length exceeds maximum"); // rest of the function }

Define

MAX_ARRAY_LENGTHas a constant with an appropriate value. - Before iterating over arrays, verify that the length of the array is within reasonable bounds to prevent exhaustion. Utilize the

-

Limit Iteration:

- Use a

forloop to iterate over the array elements, ensuring that the loop index is incremented properly within the loop body. Avoid using unbounded loops relying on external conditions.

function executeRedemptionTrades(uint256[] memory exitBalances) external { require(exitBalances.length <= MAX_ARRAY_LENGTH, "Inner array length exceeds maximum"); // rest of the loop body }

Ensure that inner arrays are also bounded.

- Use a

-

Gas Limit Consideration:

- Recognize that large arrays or nested loops can consume a significant amount of gas, and there's a gas limit for each Ethereum block. If the array size or computation is too large, the function might fail to execute. Consider breaking down the task into smaller transactions if necessary.

Always tailor these validations to your specific use case and the constraints of your smart contract. Adjust the MAX_ARRAY_LENGTH and other parameters based on your system's requirements and limitations.

Duplicate of #32

shealtielanz - `_mintVaultShares()` in `SingleSidedLPVaultBase.sol` can revert unexpectedly, causing DOS to deposits from notional.

shealtielanz

medium

_mintVaultShares() in SingleSidedLPVaultBase.sol can revert unexpectedly, causing DOS to deposits from notional.

Summary

the call to _mintVaultShares() can revert for a certain vault share greater than type(uint80).max on the call to .toUint80 due to overflow.

Vulnerability Detail

The SingleSidedLPVaultBase contract during the execution of _depositFromNotional() function calls the internal function _mintVaultShares().

Inside this function could be seen casting uint256 typed local variables to uint80 type:

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L229C1-L240C64

function _mintVaultShares(uint256 lpTokens) internal returns (uint256 vaultShares) {

StrategyVaultState memory state = VaultStorage.getStrategyVaultState();

if (state.totalPoolClaim == 0) {

// Vault Shares are in 8 decimal precision

//@audit the percison used to divide is above the normal percios and would lead to low amounts

vaultShares = (lpTokens * uint256(Constants.INTERNAL_TOKEN_PRECISION)) / POOL_PRECISION();

} else {

vaultShares = (lpTokens * state.totalVaultSharesGlobal) / state.totalPoolClaim; //@audit in a situation we have a low enough ppoltoclaim the vault shares can go above uint80.

}

// Updates internal storage here

state.totalPoolClaim += lpTokens;

state.totalVaultSharesGlobal += vaultShares.toUint80();

state.setStrategyVaultState();

..SNIP..This casting could be considered safe only based on the assumption that value of vaultShares returned would always be less than uint80.maxValue.

However, we could see that this assumption would be wrong in case of low enough totalPoolClaim amount in the pool.

if (state.totalPoolClaim == 0) {

// Vault Shares are in 8 decimal precision

//@audit the percison used to divide is above the normal percios and would lead to low amounts

vaultShares = (lpTokens * uint256(Constants.INTERNAL_TOKEN_PRECISION)) / POOL_PRECISION();

} else {

vaultShares = (lpTokens * state.totalVaultSharesGlobal) / state.totalPoolClaim; //@audit in a situation we have a low enough ppoltoclaim the vault shares can go above uint80.

}With a small state.totalPoolClaim where state.totalPoolClaim != 0 , big lpTokens and state.totalVaultSharesGlobal values, the calculation could result in a vaultShares that is greater than uint80.maxValue.

This will lead to an overflow on the line state.totalVaultSharesGlobal += vaultShares.toUint80(); causing a revert, resulting to DOS on the call to deposit from notional.

Impact

This would brick deposits from notional on the call to _depositFromNotional()

Code Snippet

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L229C1-L240C64

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L195C1-L223C43

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L240

Tool used

Manual Review

Recommendation

Consider changing the state.totalVaultSharesGlobal field type from uint80 to uint256.

dany.armstrong90 - CrossCurrencyVault.sol#_redeemfCash: IWrappedfCash#redeem function call will revert.

dany.armstrong90

high

CrossCurrencyVault.sol#_redeemfCash: IWrappedfCash#redeem function call will revert.

Summary

Since the parameter types and numbers of IWrappedfCash#redeem function call in CrossCurrencyVault.sol#_redeemfCash does not coincide with function declaration, function calls will revert.

Vulnerability Detail

CrossCurrencyVault.sol#_redeemfCash function is as follows.

File: CrossCurrencyVault.sol

278: function _redeemfCash(bool isETH, uint256 maturity, uint256 vaultShares) private {

279: IWrappedfCash wfCash = getWrappedFCashAddress(maturity);

280: uint256 assets = wfCash.redeem(vaultShares, address(this), address(this));

281:

282: if (isETH) WETH.withdraw(assets);

283: }On the other hand, IWrappedfCash.sol#redeem function declaration is as follows.

File: IWrappedfCash.sol

34: function redeem(uint256 amount, RedeemOpts memory data) external;

35: function redeemToAsset(uint256 amount, address receiver, uint32 maxImpliedRate) external;

36: function redeemToUnderlying(uint256 amount, address receiver, uint32 maxImpliedRate) external;Since the parameter types and numbers of IWrappedfCash#redeem function call does not coincide with function declaration, function calls will revert.

Impact

When maturity < Constants.PRIME_CASH_VAULT_MATURITY, redeemFromNotional and convertVaultSharesToPrimeMaturity function call to CrossCurrencyVault will revert at any time.

Code Snippet

Tool used

Manual Review

Recommendation

Ensures that the parameter types and numbers of IWrappedfCash#redeem function call coincides with function declaration.

Vagner - `getOraclePrice` in `SingleSidedLPVaultBase.sol` does not check if the sequencer is down for Arbitrum/Optimism

Vagner

medium

getOraclePrice in SingleSidedLPVaultBase.sol does not check if the sequencer is down for Arbitrum/Optimism

Summary

Chainlink recommends that all Optimistic L2 oracles consult the Sequencer Uptime Feed to ensure that the sequencer is live before trusting the data returned by the oracle, but this is not done in the getOraclePrice used in the SingleSidedLPVaultBase.sol by calling TRADING_MODULE contract.

Vulnerability Detail

As you can see _getOraclePairPrice calls , getOraclePrice on the TRADING_MODULE

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L323

which checks for the values that the chainlink oracle provides for those 2 assets passed as arguments,

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/trading/TradingModule.sol#L237-L261

but nowhere it is checked if the L2 sequencer is down, in the case of Arbitrum and Optimism, as recommended by Chainlink https://docs.chain.link/data-feeds/l2-sequencer-feeds.

This could lead to stale prices and wrong values, which would hurt the protocol.

Impact

Medium, since the prices returned could be stale if the sequencer is down.

Code Snippet

Tool used

Manual Review

Recommendation

Check if the sequencer is down for Arbitrum and Optimism, as per Chainlink recommendations.

Duplicate of #2

AuditorPraise - missing payable keyword on `TradingModule.executeTrade()` and `TradingModule.executeTradeWithDynamicSlippage()`, will cause VAULTS to be unable to execute trades on external exchanges via the trading module whenever ETH is the sell Token

AuditorPraise

high

missing payable keyword on TradingModule.executeTrade() and TradingModule.executeTradeWithDynamicSlippage(), will cause VAULTS to be unable to execute trades on external exchanges via the trading module whenever ETH is the sell Token

Summary

The vaults will be executing trades on external exchanges via TradingModule.executeTrade() and TradingModule.executeTradeWithDynamicSlippage() and ETH could be among the tokens to trade for primary token BUT the tradingModule.executeTrade() and TradingModule.executeTradeWithDynamicSlippage() lack the payable keyword.

Vulnerability Detail

tradingModule.executeTrade() and TradingModule.executeTradeWithDynamicSlippage() won't be able to receive ETH (Whenever ETH is sell token) because they lack the payable keyword.

This can cause reverts in some of the key functions of the vaults like:

- depositFromNotional()

- redeemFromNotional()

- reinvestReward()

Impact

vaults will be unable to execute trades on external exchanges via the trading module whenever ETH is the sell Token

Code Snippet

Tool used

Manual Review

Recommendation

Add the payable keyword to TradingModule.executeTrade() and TradingModule.executeTradeWithDynamicSlippage()

Duplicate of #51

mstpr-brainbot - Yield can be sandwiched

mstpr-brainbot

high

Yield can be sandwiched

Summary

During a reinvestment, the total claims of the pool increase, but the shares remain unaffected. Consequently, users who hold vault shares experience an increase in LP token claims on their shares. However, the reinvestment call is susceptible to being sandwiched. If a user deposits just before the reinvestment and exits immediately afterward, that user pockets the profit without being an actual vault shareholder. This action disrupts the yield of other vault shareholders.

Vulnerability Detail

Let's consider a scenario where the total vault shares amount to 100 tokens, and there are 100 LP tokens in the vault. When the reinvestment manager triggers a reinvestment, buying an additional 10 LP tokens, Alice, an MEV expert, notices this transaction in the mempool. She swiftly enters the vault just before the reinvestment occurs, mints tokens at a 1:1 ratio, and immediately after the reinvestment function, Alice exits the vault, claiming the yield for herself. This maneuver adversely affects other vault holders, resulting in them receiving lower yields, while Alice gains an unfair advantage by being in the vault for only one block.

Moreover, Alice can scale up this attack significantly. By depositing a large number of tokens via flash loans, she can acquire a substantial share from the vault. As she holds the majority of the shares, Alice receives the bulk of the yield. Consequently, other vault shareholders receive minimal yield, significantly diminishing their returns.

Impact

High since it can block the yield

Code Snippet

Tool used

Manual Review

Recommendation

Bauer - Funds Loss Risk in Exchange Rate Calculation

Bauer

high

Funds Loss Risk in Exchange Rate Calculation

Summary

The getExchangeRate() function poses a risk of funds loss within the protocol, as the current price of a vault share may be overestimated, leading to potential financial discrepancies during exchanges.

Vulnerability Detail

The function Curve2TokenConvexVault._checkPriceAndCalculateValue() fetches balances from CURVE_POOL using CURVE_POOL.balances(0) and CURVE_POOL.balances(1), then uses get_dy to obtain the price of one unit of the primary token converted to the secondary token.

function _checkPriceAndCalculateValue() internal view override returns (uint256 oneLPValueInPrimary) {

uint256[] memory balances = new uint256[](2);

balances[0] = ICurvePool(CURVE_POOL).balances(0);

balances[1] = ICurvePool(CURVE_POOL).balances(1);

// The primary index spot price is left as zero.

uint256[] memory spotPrices = new uint256[](2);

uint256 primaryPrecision = 10 ** PRIMARY_DECIMALS;

uint256 secondaryPrecision = 10 ** SECONDARY_DECIMALS;

// `get_dy` returns the price of one unit of the primary token

// converted to the secondary token. The spot price is in secondary

// precision and then we convert it to POOL_PRECISION.

spotPrices[SECONDARY_INDEX] = ICurvePool(CURVE_POOL).get_dy(

int8(_PRIMARY_INDEX), int8(SECONDARY_INDEX), primaryPrecision

) * POOL_PRECISION() / secondaryPrecision;

return _calculateLPTokenValue(balances, spotPrices);

}

Finally, the function invokes an internal function _calculateLPTokenValue() to determine the value of one LP token based on the obtained balances and spot prices from the Curve pool. The oneLPValueInPrimary is calculated as follows.

uint256 tokenClaim = balances[i] * POOL_PRECISION() / totalSupply;

if (i == PRIMARY_INDEX()) {

oneLPValueInPrimary += tokenClaim;

} else {

......

oneLPValueInPrimary += (tokenClaim * POOL_PRECISION() * primaryDecimals) /

(price * secondaryDecimals);

}

However, the issue arises from the fact that CurvePool(CURVE_POOL).balances() can be manipulated by malicious actors.

Bad actors could potentially deposit funds into CURVE_POOL in advance, artificially inflating the balances. As a result, when calculating the LP token value, the protocol would derive a value greater than expected due to the manipulated balances.

Therefore, in the getExchangeRate() function, the current price of a vault share will be greater than expected, as indicated in the following code snippet.

function getExchangeRate(uint256 /* maturity */) external view override returns (int256) {

StrategyVaultState memory state = VaultStorage.getStrategyVaultState();

uint256 oneLPValueInPrimary = _checkPriceAndCalculateValue();

// If inside an emergency exit, just report the one LP value in primary since the total

// pool claim will be 0

if (state.totalVaultSharesGlobal == 0 || isLocked()) {

return oneLPValueInPrimary.toInt();

} else {

uint256 lpTokensPerVaultShare = (uint256(Constants.INTERNAL_TOKEN_PRECISION) * state.totalPoolClaim)

/ state.totalVaultSharesGlobal;

return (oneLPValueInPrimary * lpTokensPerVaultShare / POOL_PRECISION()).toInt();

}

}

Furthermore, in the reinvestReward() function, the invocation of _checkPriceAndCalculateValue() may lead to a revert, preventing the successful execution of the reinvestment process, possibly due to the the same issue.

Impact

Resulting in a loss of funds within the protocol during exchanges.

Code Snippet

Tool used

Manual Review

Recommendation

shealtielanz - TradingUtils._executeTrade() will leak ETH to WETH

shealtielanz

high

TradingUtils._executeTrade() will leak ETH to WETH

Summary

If sellToken is ETH, and using Uniswap for the dex, and it is exact out trade, too much is deposited to the WETH and does not withdraw the excess amount. It will give wrong amountSold value as well as accounting error.

Vulnerability Detail

trade.sellToken is ETH and using Uniswap as dex, WETH should be used instead of ETH as Uniswap does not support ETH. There for TradingUtils wraps the ETH to WETH before trading.

If the trade would be exact out, the amount trade.limit will be deposited to WETH instead of the trade.amount. However, because it is exact out, not all ETH deposited will be traded. In the current implementation, there is no logic to recover the excess deposit.

As the TradingUtils::_executeInternal, which uses the TradingUtils::_executeTrade will calculate the amountSold based on the balance of ETH, it will return the trade.limit as the amountSold, thus resulting in accounting error.

Impact

amountSold will reflect not the amount really sold, rather the trade.limit. It is unclear whether the excess amount of ETH, which is deposited for WETH can be recovered.

Code Snippet

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/trading/TradingUtils.sol#L143C1-L151C10

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/trading/TradingUtils.sol#L28C1-L63C6

Tool used

Manual Review, exactly same issue was found in the notional past audit but the fix isn't implemented in this current codebase,

link here

Recommendation

In the _executeTrade, if the sellToken is ETH and it is exact out trade, recover excess deposit

Bauer - Potential Stranded Rewards in Aura Pool for Newly Added Tokens

Bauer

high

Potential Stranded Rewards in Aura Pool for Newly Added Tokens

Summary

The introduction of new rewards to the Aura pool may result in the tokens becoming stranded within the protocol, rendering them inaccessible for withdrawal.

Vulnerability Detail

If a new reward token is added to the Aura pool, calling getReward() will introduce the new reward token into the protocol. However, when the REWARD_REINVESTMENT_ROLE executes reinvestReward(), there is a check in _isInvalidRewardToken() that verifies the token against the ones specified during initialization.

function _isInvalidRewardToken(address token) internal override view returns (bool) {

return (

token == TOKEN_1 ||

token == TOKEN_2 ||

token == TOKEN_3 ||

token == TOKEN_4 ||

token == TOKEN_5 ||

token == address(AURA_BOOSTER) ||

token == address(AURA_REWARD_POOL) ||

token == address(Deployments.WETH)

);

}

Since the newly added reward token is not part of the initial specification, the validation fails. As a result, the token cannot be exchanged for pool tokens and cannot be withdrawn, remaining indefinitely within the protocol.

Impact

The introduction of new rewards to the Aura pool may result in the tokens becoming stranded within the protocol。

Code Snippet

Tool used

Manual Review

Recommendation

AuditorPraise - The `convertVaultSharesToPrimeMaturity()` function lacks the whenNotLocked() modifier

AuditorPraise

medium

The convertVaultSharesToPrimeMaturity() function lacks the whenNotLocked() modifier

Summary

All key external functions in the vault are supposed to have the whenNotLocked() modifier, in case of an emergency but convertVaultSharesToPrimeMaturity() doesn't

Vulnerability Detail

From the convertVaultSharesToPrimeMaturity() function an account can withdraw settled fCash to underlying from the fCash wrapper and deposit back into Notional as Prime Cash from Notional contract.

The issue is that this feature should also be restricted in the case of an emergency.

When there is an emergency the vault has to be fully locked, i.e no funds entering and no funds leaving the vaults.

Moreover the SingleSidedLPVaultBase.emergencyExit() will lock the vault so that no entries, exits or valuations of vaultShares can be performed, but since the convertVaultSharesToPrimeMaturity() function lacks the whenNotLocked() modifier, there will still be exits and valuations of vaultShares in the locked vault.

Impact

An account can withdraw settled fCash to underlying from the fCash wrapper and deposit back into Notional as Prime Cash from Notional contract even when there's an emergency that requires the vaults to be fully locked.

The vault is locked so that no entries, exits or valuations of vaultShares can be performed but the intention for which the vaults were locked can be ruined via convertVaultSharesToPrimeMaturity() function as it lacks the whenNotLocked() modifier.

Code Snippet

Tool used

Manual Review

Recommendation

Add the whenNotLocked() modifier to the convertVaultSharesToPrimeMaturity() function

mstpr-brainbot - Restoring the vault can result in big losses if balances are changed

mstpr-brainbot

medium

Restoring the vault can result in big losses if balances are changed

Summary

When a vault is in a paused state, it indicates an emergency situation where an emergency withdrawal has been executed. This withdrawal removes the balanced liquidity from all coins of the underlying tokens. Restoring the vault involves adding liquidity using the current balances of the vault, assuming that whatever tokens were withdrawn from the pool during the emergency exit will be balanced when deposited back into the pool during restoration. However, changes in pool balances can occur when the vault decides to restore, potentially resulting in the vault receiving fewer LP tokens based on the current balances.

Vulnerability Detail

Let's consider an example where the underlying Curve pool utilized by the vault contains a total of 100 tokens, with 20 tokens being X and the remaining 80 tokens being Y within the pool. For simplicity, let's assume that half of the LP tokens are held by the vault.

At a certain point, an emergency withdraw is initiated by the emergency role holder, causing the vault to remove its balanced liquidity. Given that the vault possesses half of the liquidity, the withdrawn amounts are 10 X and 40 Y.

After some time, the emergency situation is resolved, and the administrator intends to restore the vault. However, the underlying pool composition has changed, now consisting of 80% X and 20% Y, while maintaining the same total token sum. In this scenario, restoring the vault solely with the existing balances might not be the most prudent choice. This assumption is made based on the possibility of external markets where the vault's underlying tokens can be exchanged and added to the pool more efficiently, aiming to maximize the LP.

Aside from the above example, it is also possible for an attacker to manipulate the pool balances to give Notional a lesser LP share hence lesser value on the strategy token.

Impact

The above scenarios are considering the total sum of tokens are not changed but only the ratios did. It is also possible that the sum of tokens has changed which would lead to Notional to get higher or lower LP token amounts. However, this is not something that Notional admin can control so that's why I didn't include that part in above. However, considering sums are same or very near to what it was when emergency withdraw is called, just because the lack of selling optionality vault will have less LP tokens and users will have less LP token claims. That's why I interpreted this as medium.

Code Snippet

Tool used

Manual Review

Recommendation

Allow the notional owner to sell some tokens to external markets just as it allows in deposits. Notional admin is trusted and also executeDepositTrades are well protected so it does make sense to allow restoreVault sell tokens when adding LP back to pool.

Duplicate of #82

mstpr-brainbot - Reward token can be an underlying token and it would not be possible to reinvest rewards

mstpr-brainbot

medium

Reward token can be an underlying token and it would not be possible to reinvest rewards

Summary

Some pools can have reward tokens as same as one of the underlying token. In this case Notional reward investor role will not be able to compound the rewards properly and the rewards will be stuck in the contract.

Vulnerability Detail

As Notional considers all pools containing one of the underlying assets usable, certain pools may have reward tokens identical to one of the underlying tokens. However, compounding these rewards might not be feasible due to the checks in the executeRewardTrades function.

Consider the scenario where Notional selects the rETH-wstETH single-sided vault for its ETH, which is a strong candidate. Yet, additional rewards from the Curve gauge might also be in wstETH. Lido has contemplated rewarding some pools similarly, such as the stETH-ETH pool, where they provide wstETH instead of LDO. If such a situation arises, wherein wstETH is both an underlying asset and a reward source from the Convex gauge, rewardInvestors won't be able to claim and reinvest those wstETH rewards due to the following check:

if (_isInvalidRewardToken(rewardToken)) revert Errors.InvalidRewardToken(rewardToken);

and this is the invalidRewardToken

function _isInvalidRewardToken(address token) internal override view returns (bool) {

return (

token == TOKEN_1 ||

token == TOKEN_2 ||

token == address(CURVE_POOL_TOKEN) ||

token == address(CONVEX_REWARD_POOL) ||

token == address(CONVEX_BOOSTER) ||

token == Deployments.ALT_ETH_ADDRESS

);

}This function validates that selling rewards, which are also underlying tokens, isn't possible.

Impact

1-Reward tokens can be underlying tokens and notional has no control over it

2- Since all curve pools can be used, any pool that has crv-cvx-bal pairs also be used and they are reward tokens

Considering above points, I think this is a valid medium

Code Snippet

https://github.com/sherlock-audit/2023-10-notional/blob/7aadd254da5f645a7e1b718e7f9128f845e10f02/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L385-L427

https://github.com/sherlock-audit/2023-10-notional/blob/7aadd254da5f645a7e1b718e7f9128f845e10f02/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L422

https://github.com/sherlock-audit/2023-10-notional/blob/7aadd254da5f645a7e1b718e7f9128f845e10f02/leveraged-vaults/contracts/vaults/curve/ConvexStakingMixin.sol#L60-L69

Tool used

Manual Review

Recommendation

Make a flag that tells the contract reward token is also an underlying token of the pool. Vault contract should never have idle tokens as long as it is not paused and when its paused reinvesting rewards are not possible. Hence, I think it is safe to say that allowing reward investors to sell reward/underlying tokens in general

Duplicate of #84

eeshenggoh - No Protection of Uninitialized Implementation Contracts From Attacker

eeshenggoh

medium

No Protection of Uninitialized Implementation Contracts From Attacker

Summary

The inclusion of the _disableInitializers function in the abstract contract serves as a proactive security measure, providing a foundation for controlled initialization behavior in the contract's inheritance hierarchy. Although the function may not be currently employed, its presence establishes a robust design pattern, preparing the contract for potential future scenarios where preventing further initialization becomes essential.

Vulnerability Detail

The vulnerability mitigated by using _disableInitializers relates to the possibility of an attacker exploiting reinitialization, potentially compromising the contract's intended behavior. However all contracts which implements AccessControlUpgradeable & Initializable do not call _disableInitializers in the constructors Without the proper use of _disableInitializers, the contract might be susceptible to unexpected reinitialization, leading to unanticipated consequences and potential security risks.

To further prove my point in the contracts/proxy/utils/Initializable.sol it states the following:

* Avoid leaving a contract uninitialized.

* An uninitialized contract can be taken over by an attacker. This applies to both a proxy and its implementation

* contract, which may impact the proxy. To prevent the implementation contract from being used, you should invoke

* the {_disableInitializers} function in the constructor to automatically lock it when it is deployed:https://github.com/OpenZeppelin/openzeppelin-contracts/blob/6bc1173c8e37ca7de2201a0230bb08e395074da1/contracts/proxy/utils/Initializable.sol#L41C1-L46C3

Impact

Failure to use _disableInitializers could allow an attacker to exploit the contract's initialization process, leading to unexpected behavior, security vulnerabilities, or even a complete compromise of the contract's functionality. This vulnerability could impact the security and reliability of the contract, potentially putting user funds or sensitive operations at risk.

Code Snippet

**All Vaults Affected**

* leveraged-vaults/contracts/vaults/*Tool used

Manual Review

Recommendation

For contracts that inherit BaseStrategyVault, do include the following

abstract contract BaseStrategyVault is Initializable, IStrategyVault, AccessCont

/// @notice Set the NOTIONAL address on deployment

constructor(NotionalProxy notional_, ITradingModule tradingModule_) initializer {

// Make sure we are using the correct Deployments lib

+ //@audit-issue Prevent further re-initialization of the implementation contract

+ _disableInitializers();

uint256 chainId = 42161;

//assembly { chainId := chainid() }

require(Deployments.CHAIN_ID == chainId);For contracts that do not inherit BaseStrategyVault do include _disableInitializers() in constructor

shealtielanz - Unexpected behavior for UniV3Adapter, and ZeroExAdapter when msgValue is not zero

shealtielanz

medium

Unexpected behavior for UniV3Adapter, and ZeroExAdapter when msgValue is not zero

Summary

Unexpected behavior for UniV3Adapter, and ZeroExAdapter when msgValue is not zero.

Vulnerability Detail

UniV3Adapter, and ZeroExAdapter are assuming msgValue is zero. But the caller logic is shared between BalancerV2Adapter and CurveAdapter which support positive msgValue. So, there is a chance that UniV3Adapter, and ZeroExAdapter will be given positive msgValue. Since they don't handled positive msgValue cases, it will return an unexpected behavior.

Impact

If msgValue is not zero, UniV3Adapter, and ZeroExAdapter may execute unexpected behavior, also some trades will be impossible in Notional

Code Snippet

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/trading/adapters/UniV3Adapter.sol#L89C1-L112C2

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/trading/adapters/ZeroExAdapter.sol#L12C1-L25C6

Tool used

Manual Review

Recommendation

Unexpected behavior for UniV3Adapter, and ZeroExAdapter when msgValue is not zero

function getExecutionData(address from, Trade calldata trade)

internal view returns (

address spender,

address target,

uint256 msgValue,

bytes memory executionCallData

)

{

...

require(msgValue == 0, "Positive msgValue not allowed");

...

}Vagner - `BalancerWeightedAuraVault.sol` wrongly assumes that all of the weighted pools uses `totalSupply`

Vagner

high

BalancerWeightedAuraVault.sol wrongly assumes that all of the weighted pools uses totalSupply

Summary

BalancerWeightedAuraVault.sol which is used specifically for weighted balancer pools wrongly uses totalSupply all the time to get the total supply of the pool, but this would not be true for newer weighted pools.

Vulnerability Detail

Balancer pools have different methods to get their total supply of minted LP tokens, which is also specified in the docs here

https://docs.balancer.fi/concepts/advanced/valuing-bpt/valuing-bpt.html#getting-bpt-supply .

The docs specifies the fact that totalSupply is only used for older stable and weighted pools, and should not be used without checking it first, since the newer pools have pre-minted BPT and getActualSupply should be used in that case. Most of the time, the assumption would be that only the new composable stable pools uses the getActualSupply, but that is not the case, since even the newer weighted pools have and uses the getActualSupply. To give you few examples of newer weighted pools that uses getActualSupply

https://etherscan.io/address/0x9f9d900462492d4c21e9523ca95a7cd86142f298

https://etherscan.io/address/0x3ff3a210e57cfe679d9ad1e9ba6453a716c56a2e

https://etherscan.io/address/0xcf7b51ce5755513d4be016b0e28d6edeffa1d52a

the last one also being on Aura finance. Because of that, the interaction with newer weighted pools and also the future weighted pools would not be accurate since the wrong total supply is used and calculations like _mintVaultShares and _calculateLPTokenValue would both be inaccurate, which would hurt the protocol and the users.

Impact

Impact is a high one since the calculation of shares and the value of the LP tokens is very important for the protocol, and any miscalculations could hurt the protocol and the users a lot.

Code Snippet

Tool used

Manual Review

Recommendation

Since the protocol would want to interact with multiple weighted pools, try to check first if the weighted pool you are interacting with is a newer one and uses the getActualSupply or if it is an older one and uses totalSupply, in that way the protocol could interact with multiple pools in the long run.

Vagner - Most of the composable stable pools uses wstETH on the mainnet, which is would not work with the current codebase because of `_getOraclePairPrice`

Vagner

medium

Most of the composable stable pools uses wstETH on the mainnet, which is would not work with the current codebase because of _getOraclePairPrice

Summary

Most of the composable stable pool on Balancer uses wstETH as one of the tokens, but that would not be compatible with BalancerComposableAuraVault.sol because there is no mainnet oracle compatible with wstETH, so the function _getOraclePairPrice used in _calculateLPTokenValue would not be possible to be used.

Vulnerability Detail

As you can see on the balancer composable stable pools page for mainnet

https://app.balancer.fi/#/ethereum

most of the pools, and especially the ones with the biggest values, uses wstETH as one of their assets. The problem with the current codebase is that wstETH would not be compatible with the current _getOraclePairPrice function. As you can see _checkPriceAndCalculateValue calls _calculateLPTokenValue

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/BalancerComposableAuraVault.sol#L104

which calls _getOraclePairPrice

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L351

if the assets provided is not the primary index one. Now if we look at the _getOraclePairPrice function, it calls getOraclePrice on the TRADING_MODULE contract

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/SingleSidedLPVaultBase.sol#L323

which uses the chainlink oracle to get the latest round data for those 2 assets provided in the _getOraclePairPrice function

https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/trading/TradingModule.sol#L237-L261

but since wstETH is not supported on any mainnet oracle, the whole function could not be used. To be more specifically, there will be issues when anytime when _checkPriceAndCalculateValue, which is on reinvestReward , getExchangeRate

and convertStrategyToUnderlying functions in SingleSidedLPVaultBase.sol.

Impact

Impact is a medium one since reinvesting and other functionalities would not be possible, in those cases.

Code Snippet

Tool used

Manual Review

Recommendation

Use another way of checking the price of wstETH, since avoiding interacting with it would make using most of the composable pool impossible.

squeaky_cactus - `chainId` of Arbitum breaks Mainnet and Optimism deployments

squeaky_cactus

medium

chainId of Arbitum breaks Mainnet and Optimism deployments

Summary

The constructor of BaseStrategyVault requires the chain id matches that from Deployments.CHAIN_ID (the value assigned is 42161, the Arbitum chain id).

Although Deployments.sol is out of scope, in scope Deployments.CHAIN_ID is used to control program flow, deciding which chain specific functions are invoked on external contracts. The outcome always being the same, irrespective of the chain deployed onto, only the Arbitum path is ever used.

Vulnerability Detail

The constructor of BaseStrategyVault contains the setting of chainId to 42161 (Arbitum chain).

constructor(NotionalProxy notional_, ITradingModule tradingModule_) initializer {

// Make sure we are using the correct Deployments lib

uint256 chainId = 42161;

//assembly { chainId := chainid() }

require(Deployments.CHAIN_ID == chainId);

NOTIONAL = notional_;

TRADING_MODULE = tradingModule_;

}Throughout the code the constant Deployments.CHAIN_ID is used, rather than retrieving the chain id, resulting in the

flow control gates always choosing the Arbitum path.

An example is Curve2TokenConvexVault._joinPoolAndStake, where Deployments.CHAIN_ID will always be Arbitum (as its enforced in the constructor), resultingly the Mainnet path will never be used, even on Mainnet.

if (Deployments.CHAIN_ID == Constants.CHAIN_ID_MAINNET) {

success = IConvexBooster(CONVEX_BOOSTER).deposit(CONVEX_POOL_ID, lpTokens, true);

} else if (Deployments.CHAIN_ID == Constants.CHAIN_ID_ARBITRUM) {

success = IConvexBoosterArbitrum(CONVEX_BOOSTER).deposit(CONVEX_POOL_ID, lpTokens);

}Given the commented out inline Yul { chainId := chainid() }, this might have been a work-around for dev/testing,

but this being the code under audit, I'd feel remissed in omitting it.

Impact

The Notional Update 4 ReadMe states the deployment chains that need supporting:

Q: On what chains are the smart contracts going to be deployed?

Arbitrum, Mainnet, Optimism

Requirements on any mismatch between Deployments.sol and chain id from Discord channel notional-update-4-nov-18:

Jeff Wu | Notional:

Getting a few questions about the constructor in the BaseStrategyVault and the check against chainid.

There are some constants in Deployments.sol which are chain specific.

The constructor should revert if the contract is being deployed to a mismatched chain from the Deployments.sol file it is compiled with.

The constructor does not revert when there is a mismatched chain from the Deployments.sol, failing the requirement.

The control flow effected when deployed on:

- Mainnet: an unusable

Curve2TokenConvexVaultwould be deployed, with the stake, unstake and claim rewards

functions that will all revert. - Optimism:

Curve2TokenConvexVaultcan be deployed (against the intention in the code against unsupported chains), with

reverting stake, claim and reward functions.

Deployments.sol holds chain specific addresses (although some addresses are common across chains),

Mainnet and Optimism deployments would be using the Arbitum address, some would be incorrect, resulting

in failing calls to routers and wrapped staked ether.

Code Snippet

Tool used

Manual Review

Recommendation

In the constructor of BaseStrategyVault check the id of the chain being deployed on against the Deployments.sol being used.

- uint256 chainId = 42161;

- //assembly { chainId := chainid() }

- require(Deployments.CHAIN_ID == chainId);

+ require(Deployments.CHAIN_ID == block.chainId);Duplicate of #73

shealtielanz - setting deadline to block.timestamp can be very problematic when trades are in the mempool.

shealtielanz

medium

setting deadline to block.timestamp can be very problematic when trades are in the mempool.

Summary

in StrategyUtils.sol during execution of dynamic and static trades it sets the deadline to block.timestamp automatically, this is bad as setting to block.stamp allows a miner/bundler to hold a trade in the mempool and execute it at anytime of their wanting which can be used to cause grief traders due to their trades being executed at a time they do not want which can lead them to accrue losses. this can also be used to sandwich trades to make gain.

Vulnerability Detail

you can see in StrategyUtils.sol _executeDynamicSlippageTradeExactIn() and _executeTradeWithStaticSlippage() the deadlin for the trades are set to block.timestamp.

function _executeDynamicSlippageTradeExactIn(

..SNIP..

Trade memory trade = Trade(

params.tradeType,

sellToken,

buyToken,

amount,

0, // No absolute slippage limit is set here

block.timestamp, // deadline

params.exchangeData

);

..SNIP..

function _executeTradeWithStaticSlippage(

..SNIP..

Trade memory trade = Trade(

params.tradeType,

sellToken,

buyToken,

amount,

params.oracleSlippagePercentOrLimit,

block.timestamp, // deadline

params.exchangeData

);

..SNIP..Impact

This allows trades to be vulnerable to MEV attacks and trades can settle in unfavourable times that will lead to loses to Traders.

Code Snippet

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L134C1-L142C11

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/common/StrategyUtils.sol#L164C1-L172C11

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/CrossCurrencyVault.sol#L248

- https://github.com/sherlock-audit/2023-10-notional/blob/main/leveraged-vaults/contracts/vaults/CrossCurrencyVault.sol#L177

Tool used

Manual Review

Recommendation

allow callers specify their custom deadlines

Duplicate of #115

coffiasd - Checking for an invalid reward token could potentially lead to a executeRewardTrades DOS

coffiasd

medium

Checking for an invalid reward token could potentially lead to a executeRewardTrades DOS

Summary

Checking for an invalid reward token could potentially lead to a executeRewardTrades DOS.

Vulnerability Detail

Bot can claim reward tokens from reward pool and then reinvest them as LP tokens which are donated to all vault users。This requires the following 2-step process :

- 1.claimRewardTokens

- 2.reinvestReward

There exist a _isInvalidRewardToken to ensure reward token is not in list of pool tokens

function _isInvalidRewardToken(address token) internal override view returns (bool) {

return (

token == TOKEN_1 ||

token == TOKEN_2 ||

token == TOKEN_3 ||

token == TOKEN_4 ||

token == TOKEN_5 ||

token == address(AURA_BOOSTER) ||

token == address(AURA_REWARD_POOL) ||

token == address(Deployments.WETH)

);

}The reward token present is the BAL token, which is claimed from the ARUA reward pool 。 However it is possible that the BAL token is inside the pool .

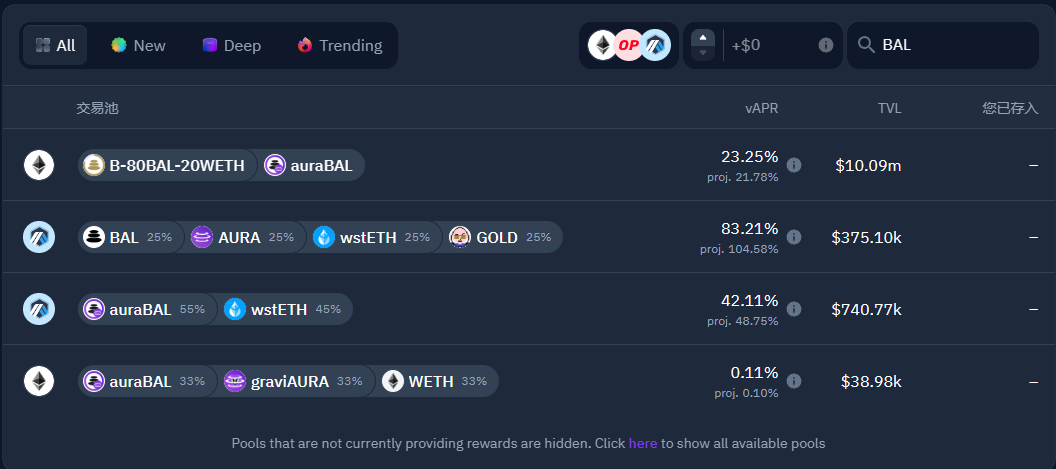

Here is a list of pools from AURA:

And I believe there is a possibility of adding more pools in the future that include BAL。If this type of pool encounters a revert during the reinvestReward operation in the bot, it could lead to a denial-of-service (DOS).

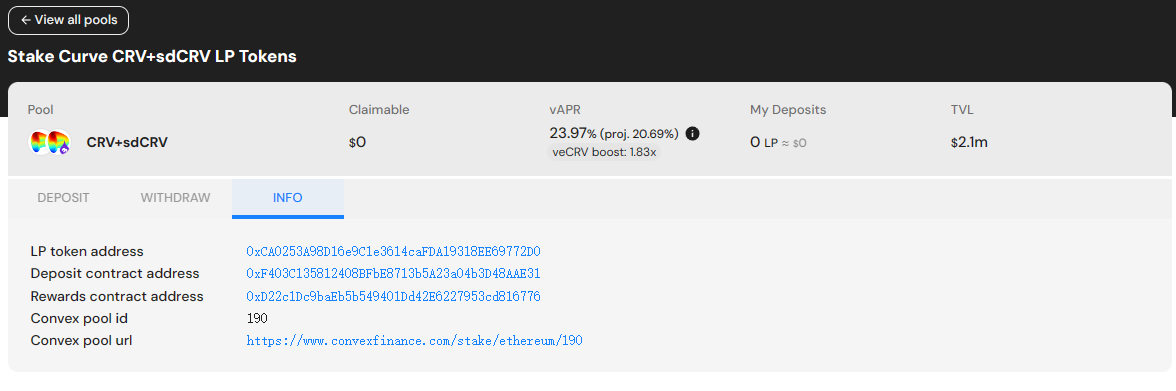

And the same with curve

coins[0] in above LP is CRV 0xD533a949740bb3306d119CC777fa900bA034cd52

Reward token from rewardPool is also CRV 0xD533a949740bb3306d119CC777fa900bA034cd52

Impact

bot can not invoke reinvestReward due to revert

Code Snippet

function _isInvalidRewardToken(address token) internal override view returns (bool) {

return (

token == TOKEN_1 ||

token == TOKEN_2 ||

token == TOKEN_3 ||

token == TOKEN_4 ||

token == TOKEN_5 ||

token == address(AURA_BOOSTER) ||

token == address(AURA_REWARD_POOL) ||

token == address(Deployments.WETH)

);

}Tool used

Manual Review

Recommendation

ensure BAL token is not in the pool

Duplicate of #84

ke1caM - `block.timestamp` offers no protection as a deadline for a swap

ke1caM

medium

block.timestamp offers no protection as a deadline for a swap

Summary

block.timestamp will have the value of whichever block the txn is inserted into, hence the txn can be held indefinitely by malicious validators.

Vulnerability Detail

Block proposers have advance knowledge of whether they will be suggesting individual blocks or a sequence of blocks ahead of time. In this situation, a dishonest validator could delay a transaction and carry it out at a more advantageous block number.

Impact

Transaction can be validated at further blocks on less favorable terms.

Code Snippet

Tool used

Manual Review

Recommendation

Allow sender of the transaction to parameterize deadline parameter of a trade / swap.

Duplicate of #115

AuditorPraise - if `isSingleSided` bool is false, execution of trades back to the primary token on external exchanges will fail due to non-transfer of the balance of the other tokens to be sold for primary token into the trading Module

AuditorPraise

high

if isSingleSided bool is false, execution of trades back to the primary token on external exchanges will fail due to non-transfer of the balance of the other tokens to be sold for primary token into the trading Module

Summary

the balance of the other tokens to be sold for primary token is never transferred into the trading module, hence trading module has nothing to trade with.

Vulnerability Detail

SingleSidedLPVaultBase._redeemFromNotional() uses StrategyUtils.executeRedemptionTrade() to execute redemption trades whenever isSingleSided bool is false

Now the issue is that the balance of the other tokens to be sold for primary token is never transferred into the trading module, so the trading module has no funds to trade with on the external exchanges.

Here's the flow of a redemption trade:

-

BaseStrategyVault.redeemFromNotional()callsSingleSidedLPVaultBase._redeemFromNotional()here -

SingleSidedLPVaultBase._redeemFromNotional()usesStrategyUtils.executeRedemptionTradesfor execution of trades on external exchanges here -

StrategyUtils.executeRedemptionTradescalls_executeDynamicSlippageTradeExactIn()here -

_executeDynamicSlippageTradeExactIn()makes the call toTradeHandler._executeTrade()here -

The main issue lies here in the

TradeHandler._executeTrade().

TheTradeHandler._executeTrade()just makes a delegate call to the trading module without transferring the amount of sellToken to trade into the trading module.

Impact

if isSingleSided bool is false, execution of trades back to the primary token on external exchanges will fail due to non-transfer of the balance of the other tokens to be sold for primary token into the trading Module

SingleSidedLPVaultBase._redeemFromNotional() will always revert due to lack of funds to execute trades on trading module as the funds were never transferred into the trading module.

Code Snippet

Tool used

Manual Review

Recommendation

Have the vaults transfer amount of sellToken to execute trades with into the TradingModule.sol.

djanerch - Functions can reach block gas-limit via unbounded operations