The stock market is known for being volatile, dynamic, and nonlinear. Accurate stock price prediction is extremely challenging because of multiple (macro and micro) factors, such as politics, global economic conditions, unexpected events, a company’s financial performance, and so on.

But, all of this also means that there’s a lot of data to find patterns in. So, financial analysts, researchers, and data scientists keep exploring analytics techniques to detect stock market trends. This gave rise to the concept of algorithmic trading, which uses automated, pre-programmed trading strategies to execute orders.

- Fundamental analysis

- Technical analysis

- Analyzes measurable data from stock market activities, such as stock prices, historical returns, and volume of historical trades; i.e. quantitative information that could identify trading signals and capture the movement patterns of the stock market.

- Technical analysis focuses on historical data and current data just like fundamental analysis, but it’s mainly used for short-term trading purposes.

- Due to its short-term nature, technical analysis results are easily influenced by news. Popular technical analysis methodologies include moving average (MA), support and resistance levels, as well as trend lines and channels.

- Included Data from all the tickers in the Tehran Market Data(

MarketWatchPlusin TSE) - descriptive fields:

ID,ISIN,symbol,full-name

- trades information

- first_price, close_price, last_price , min , max, return , last_return

- volume, value

- orderbook:

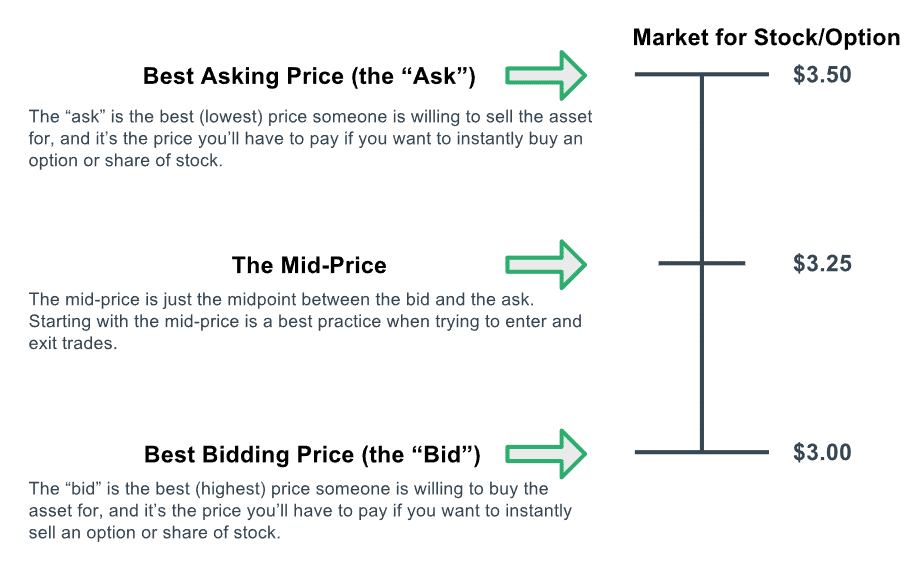

- bid price : The bid price refers to the

highestprice a buyer will pay for a security - ask price : The ask price refers to the

lowestprice a seller will accept for a security.

- bid price : The bid price refers to the

Stock price prediction is the act of forecasting stock prices based on historical data. We used historical data in machine learning to recognize trends and understand the current market. Machine learning automates the trading process by using statistical models to draw insights and make predictions. Machine learning can collect and test a large amount of data, both structured and unstructured. It can apply suitable algorithms, transform, search for patterns, and make decisions based on the new data.