Overview:

Requester: Robin Torque

Amount requested in DFI: 150’000 first 15'000

Receiving address: dXz2YUUA4b1SVej5G6BrQf6Tz5QmsNiDT7

Reddit discussion thread: Deutsch, English

Proposal fee (10 DFI) txid: 79e94eb3bce180467aee39d053a9b1f1a9ae7dec23531e91f667bd1bf493c20e

Note: This CFP requests a distribution assuming that the specified targets are met in future. If we do not meet our goals, no DFI will be distributed. If the targets are met, the distribution should occur without having to resubmit another CFP.

While many DeFiChain users cry "when Binance" and struggle with big or small exchanges to exchange DFI into Fiat or Fiat into DFI, a small group of tech geeks is already working on an ultimate solution. A fully regulated crypto exchange that focuses exclusively on the needs of DeFiChain users and can be integrated by any other software via API. This exchange run by DeFiChain enthusiasts pursues the goal of making DeFiChain bigger and more successful.

Our Vision:

A smartphone wallet that allows anyone globally to easily buy and sell DeFiChain assets or fractions of them with a few clicks. Some users will load some pocket money into their account using a credit card and then trade some risky stocks on the decentralized exchange (DEX). Others use the app to invest in rock-solid securities via weekly bank transfers on a savings plan basis and build up wealth long-term. The app is always incredibly simple to use. Using the DEX, depositing fiat money or even withdrawing, everything works simply and smoothly. Some users use the app, as they want to be able to build a censorship-resistant and expropriation-proof stock portfolio. Others haven't even realized that this app has anything to do with Blockchain and just enjoy the simplicity of use, the 24/7 trading offer and the welcoming community that has evolved around the app.

While other communities are still spending time and energy shilling its own shitcoin on Twitter, since that's all they know how to do, DeFiChain is really taking off and in fact, we are in the phase of creating real use cases that will change the world. DeFiChain users will no longer need to shill $DFI or DeFiChain, because we have a genuine product that satisfies real needs of normal people: the ability to buy and sell any asset in the world simply and easily 24 hours 7 days a week with no minimum order size, no custody fees and no fixed fees per trade. The censorship resistance and expropriation protection that the blockchain offers comes as an additional feature on top and gives the traditional financial systems the death blow for the retail market.

In order to achieve this goal, a lot of work still needs to be done. Among other things, we need a way to switch easily from FIAT to DFI and vice versa. This is exactly what our project is about. A fully regulated exchange that can be integrated into any software via API and processes the FIAT to DFI exchange in a straight-forward and direct way.

Purpose of this project:

We want to make Fiat to crypto exchanges as easy as possible for all DeFiChain assets. While we have 1000 ideas in mind about this service, we will focus here solely on what we will realistically achieve this year.

Purchase of DFI assets without KYC via SEPA bank transfer

To do this, we use the same business model as Relai.ch . Users can enter their IBAN address in a software and select a DeFiChain asset (e.g. DFI, dBTC, LM tokens like DFI-BTC, decentralized stocks on DeFiChain) to buy. Multiple assets can be selected as well. Only one bank transaction is needed to buy the corresponding asset. The company needs to know which asset is purchased and that’s why a corresponding Order ID is transmitted in the payment message. After the company has received the transferred money, the desired asset is purchased and transferred to the user's wallet address on the blockchain. As with Relai, the user always checks the coins himself after purchasing and does not have to provide any personal data such as name or address, as verification is done via bank details only. Transfers can also be done by means of a recurring payment order, whereby a savings plan is created investing in the corresponding asset. As with Relai, there is a limit of 900 EUR or 1000 CHF per person per day or 90'000 EUR or 100'000 CHF per year.

Sale of of DFI assets without KYC via SEPA bank transfer

Only a few clicks are necessary in order to sell DeFi assets like dBTC, DFI or DFI-BTC Liquidity Pool shares in exchange for FIAT. The user selects the corresponding asset, enters the quantity and presses ‘Sell’. This transfers the corresponding asset on the blockchain to the company which exchanges the tokens into EUR and transfers the EUR amount to the customer via SEPA bank transfer. For this, the IBAN, the BIC of the bank, name, address, email address and phone number must be provided.

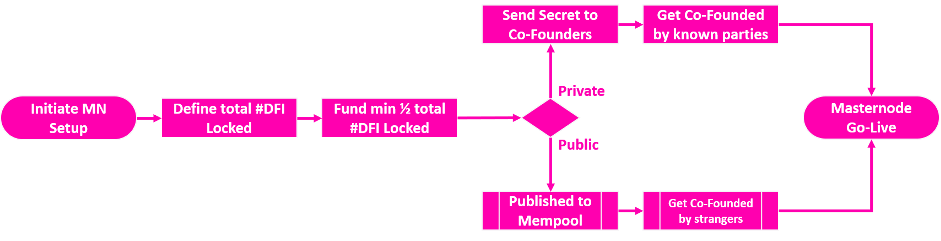

Linking with the own Masternode

We will also offer to operate our service in combination with a Masternode. A receiving wallet address of the company can be entered as the reward payout address of a Masternode. As soon as a Masternode has found a block, the DFI reward will be exchanged into EUR and transferred via SEPA bank transfer to the customer. If the user has not made a KYC and the reward is greater than 900 EUR, only 900 EUR are paid out and the remaining DFI amount is returned to the owner address of the masternode.

Use of services after conducted KYC

It will also be possible to go through a regular KYC process to execute transactions without limit.

Referral Programm

Users pay 0.5% less transaction fees by using a Ref-Link. Ref-Link providers receive 0.5% on each buy order which could become an extremely interesting model that raises the awareness of the exchange tremendously and thus, to the awareness of DFI and DeFiChain.

How will the CFP be spent?

We propose to support the launch of the DeFiChain Fiat Exchange by means of a CFP. The alternative would be to take external venture capitalists on board as investors in the company. This would make it impossible for us to work uncompromisingly for the success of DeFiChain, because the investors want to see the biggest return possible which is not our main focus. We build this service due to our conviction and enthusiasm to make DeFiChain a great DeFi project. We want to make the world a better place through financial inclusion and believe we can contribute to that with this project in combination with DeFiChain. Our efforts are focused on the users of DeFiChain and aim to make DeFiChain successful. Therefore, it is not an option for us to work with venture capitalists. All our expenses will be paid from our own savings until the launch of the Exchange and it should be possible to finance the expenses spent by means of a fee on buying and selling DeFiChain assets. However, a CFP could help us significantly to get more users on board via cheap fees and to accelerate the development.

Business Model without CFP:

Buy and sell orders of DFI cost the same as with Relai: 3% of the transaction volume. When using a Ref-Link, a buy order still costs 2.5% with 0.5% being distributed to the link provider. Buying and selling BTC or other tokens costs a bit more, because the DEX fee for exchanging assets has to be paid as well.

Business Model with CFP:

Sell orders are not subsidized and still amount to 3% of the sales volume. Buy orders on any asset are subsidized via CFP and cost only 1% without Ref-Link and 0.5% with Ref-Link measured by the buy volume, whereby this 0.5% is transferred to the Ref-Link provider.

The CFP pays out 15% of the buy volume once per successful buy order to the DeFiChain Fiat Exchange. Consequently, the CFP of 150'000 DFI is used up with a buy volume of 1 million DFI. Purchases of other assets such as BTC or DFI-BTC Liquidity Pool Tokens are also included. The company publishes all transactions with full transparency, so that anyone can verify the use of the DFI from the CFP.

Subsequently, all trades are expected to cost 3% of the buy/sell volume. The fee will continue to decrease over time, when volumes become larger. The community can also vote for another CFP to speed up the further development of the software (platform/app) and the integration of more payment channels. Before that, however, we will talk to the community first to meet the wishes of the community.

In case the CFP will be accepted, the amount of DFI will not be paid out immediately. Only AFTER the successful launch of the Exchange WITH an officially issued financial license in Switzerland and completed software, the payment of the CFP will be made as mentioned above.

DFI funds from the CFP are distributed as follows:

| Organisation behind DeFiChain Fiat Exchange (buy order subsidisation, legal/compliance, operating expenses) |

60’000 DFI |

| Marketing (Social Media campaign, ads, et cetera) |

10’000 DFI |

| Team (15 active team member at the moment) |

80’000 DFI in Total 28’500 DFI for future team members 51’500 DFI for current team∅ 3’433 DFI/team member |

| TOTAL: |

150’000 DFI |

The company behind the DeFiChain Fiat Exchange is already incorporated as a Swiss public limited company. As soon as the financial license has been granted, more details about the company incorporation can be announced within the next weeks after this CFP. This step shows our commitment to make this project a success. To achieve this ambitious goal, we need a rapidly growing user base. We intend to achieve this by subsidizing buy orders, making it attractive to use our DeFiChain Fiat Exchange as described above. This will be done by using a portion of the 60'000 DFI (50%) coming from the CFP.

Another large expense for the company is legal advice and regulatory implementation of the business model, for which 45% of the 60'000 DFI shouldl be spent. For the time being, we calculate with a scope of 100h legal consulting at an hourly rate of CHF 600 per hour!, so that there is still a small buffer for additional expenses for legal advisory. For this purpose, we have engaged the most renowned law firm in Switzerland in terms of legal advice within the blockchain space. This is imperative from our point of view, as our business model enters entirely new regulatory territory which has not been done before by any other business. In order not to jeopardize our business model, we rely on the legal assessment of our law firm. For more details regarding the legal and regulatory aspects, please contact us.

Finally, a company has running costs (domains, servers, etc.) that need to be covered, but for which only a very small portion of the 60'000 DFI will be spent (5%).

A total of 10'000 DFI of the 150'000 DFI from the CFP is supposed to be spent on marketing and most of which will go into ads. We want to run a marketing campaign on all (social media) channels right from the beginning to make potential users aware of our offer. Therefore, we are currently talking to people who are capable of running the marketing for the DeFiChain Fiat Exchange.

80'000 DFI are to be allocated in total to individual team members that we intend to use to compensate team members for the time and development work they currently volunteer in addition to their professional duties. Furthermore, 28'500 DFIs of the 80'000 DFIs are earmarked exclusively for new team members who join after this CFP. This results in an average distribution of ∅3'433 DFI/member with 15 active team members currently. We see our human capital as the most important resource for the success and rapid realization of the DeFiChain Fiat Exchange and we want to attract further dedicated people to this project through incentives coming from the CFP.

How does the DeFiChain Community benefit from this CFP?

- Each decentralized share is created by depositing DFI. For example, if someone buys a TESLA share for 100 EUR through our service, a demand for DFI worth 200 EUR is created. It is even three times that amount in the case of a DFI-TSLA Liquidity Token. By simplifying access to DeFiChain assets through our service, more money will flow into the DeFiChain ecosystem driving up the DFI value.

- Users can easily invest in DFI or make withdrawals without KYC.

- Masternode operators can have blockrewards paid out directly in EUR to their bank account without active intervention.

- The exchange will also offer advisory services and help users with high transaction volumes avoid issues with banks and other authorities. Users will be able to disclose their transaction history and thus, obtain proof of origin of funds through us. The Exchange fully supports its customers to not get into trouble with their banks. Unlike the other providers, we are able to provide this advisory by having full expertise of DeFiChain and its assets.

- The project will use a portion of the CFP for active marketing, placing advertisements on platforms such as Facebook or Instagram.

- The ref-link system will create an additional incentive to talk about DeFiChain and contribute to larger word-of-mouth spread of DeFiChain.

Team behind DeFiChain Fiat Exchange

Behind the scenes, there are currently 15 people actively working on DeFiChain Fiat Exchange: Robin Torque, Daniel Klaiber, Yannick (DeFiChain Moderator), Jonas Surmann (DeFiChain Explained), Arthur, Jeff, Felix B., DZ, Jonathan S., Santiago S. Dennis L., Pedro, Tristan W., Mark A. (DeFiChain tax group), Leon, Bernd M., Andreas L. . In addition, there are other members who serve as advisors to the DeFiChain Fiat Exchange.

Some members of the team are known from previous DeFiChain projects and let their expertise flow into the DeFiChain Fiat Exchange:

More information about our team to be found on our website: fiat2defi.ch. You are also welcome to contact us directly on Telegram: t.me/DeFiChange .

If you want to contribute to the success of DeFiChain Fiat Exchange, please reach out to us to work on the project. We are very grateful for any help.

FAQ:

Is the service also offered for CAKE or other providers?

Our API interface is open source and accessible by anyone. Any platform can implement our service without having to ask us for permission. Only our standards have to be followed.

Will other currencies for payments be offered in future?

Yes, all common currencies will be offered.

Are other payment systems offered?

Yes, we are already working on integrating as many payment systems as possible. If the CFP is approved, we will be able to further increase our efforts and accelerate the implementation of additional payment systems.

### What happens to the fees, if the user does not use a ref-link?

The money is transferred into a separate account that is used exclusively for marketing such as Facebook ads.

What happens, in case someone runs Washtrading trades to trigger the CFP distribution?

All trades made by our company will be publicly viewable and trackable on the blockchain at the outset. Wash trading can be quickly identified and will not be counted by us as real trading.

How much money and time has already been invested in the project so far?

Technology-wise, we have a whole team that has sacrificed many hours of their free time to develop the software. People who don't do things for money, but work hard for hours out of love and conviction to realize our vision. The CFP will help us to have some people working full time on the project. Cost-wise, we can't provide exact details unfortunately, however we can disclose that we are working with the most reputable blockchain law firm in Switzerland. Each lawyer costs 600 CHF per hour and other expenses accrued so far are immense (incorporation, et cetera).

Is there already a website available?

Yes, but still under development: fiat2defi.ch

How does the timeline look like?

We want to offer FIAT to Crypto money exchange within the next 2 months from now on and Crypto to FIAT within the next 3 months. Our lawyers have confirmed that this is a realistic goal, if we continue to work at this fast pace and considering the associated costs.

Can I support the project?

Yes, please have a look at our GitHub repo github.com/DeFiChange or check out our Telegram channel t.me/DeFiChange.

What is involved in software development and is everything OpenSource?

There are several ongoing software development to realize this project:

- Website

- Backend infrastructure of Crypto exchange

- API between exchange and user software

- User software

The website is open source under a Creative Commons CC BY-SA 4.0 license. The backend of the Crypto exchange cannot be easily published for security reasons and therefore remains the property of the company. The API and user software are developed under MIT license and published on GitHub: github.com/DeFiChange.

On which platforms is the service published?

We intend to publish our software on all common platforms.

Who can make a SEPA bank transfer?

SEPA is a European payment system supported by effectively all banks in European countries. We are also looking for solutions for people outside of Europe or people who do not have a bank account. The CFP will help us to add other payment systems faster to address these issues.